SatCom + Telecom Industry: Future of Global Connectivity?

As the push for big data and global connectivity continues, the satcom and telecom industries are moving closer together. Both industries have what the other is looking for. Satcom offers global coverage, independently of terrestrial infrastructure and telecom can offer standardization and quick lead times on infrastructure changes. There are still many unanswered questions as to how the two industries and technologies will be able to come together pragmatically, but one thing is certain – a convergence between satcom and telecom industries is on the horizon.

According to TechRepublic, 2022 is already a watershed year for Big Data, Artificial Intelligence, and analytics. Global data alone is projected to be around 180 zettabytes by 2025 and the world is only catching up. But is it really catching up? What’s in store with respect to connectivity, data, and practical applications that these technologies promise? According to Svend Holme Sørensen — Product Manager, at GateHouse SatCom — there’s a lot of catching up to do for Europe, and the rest of the world.

In a recent speech at Rumkonferencen 2022, he addressed the potent demand for access to real-time global data for tracking, support for big data, artificial intelligence, controlling and operating unmanned vehicles, and more — in terms of connectivity, networks, and pushing the limits of what’s possible. The surge in demand for bandwidth, coverage and speed — along with technology adoption, paying customers, and the ever-increasing list of use cases for the combined power of satcom technology, big data, and connectivity — there’s a lot going on.

The Gap & The Merger: SatCom Technology, Mobile Networks, & Connectivity

More than 90% of the Earth’s surface is still not adequately covered by terrestrial networks, according to Mr. Sørensen. For one, there’s an ever-increasing demand for real time tracking globally to support complete adoption of Big Data and its use cases. Furthermore, technologies such as Machine learning and Artificial Intelligence also require access to real-time data via connectivity. In another use case, deployment of unmanned vehicles finds uses outside of existing terrestrial coverage.

Meanwhile, for the satcom industry and for the mobile industry, it’s in their respective mutual interest to make it work. Customers today expect that it just works — staying connected everywhere and using services and accessing data is something that customers take for granted. The global telecom industry size is pegged at $US 2.47 Trillion by 2028. The global satcom industry is close to 66.63 billion and is growing at an estimated CAGR (compounded annual growth rate) of 9.8% from 2021 through 2028. Furthermore, the satcom industry is characterized by large coverage areas – even global coverage within one system – many technologies and standards and little interoperability.

Mr. Sørensen points out that satellite communication is used where there are no other options – at sea, in the air, in remote locations, etc. It’s expensive and users need to change user terminals if you want to use a different operator. The gap between the two markets is huge; the demand is just as evident.

Telecom + Satellite Technology: Marriage, Made in Space?

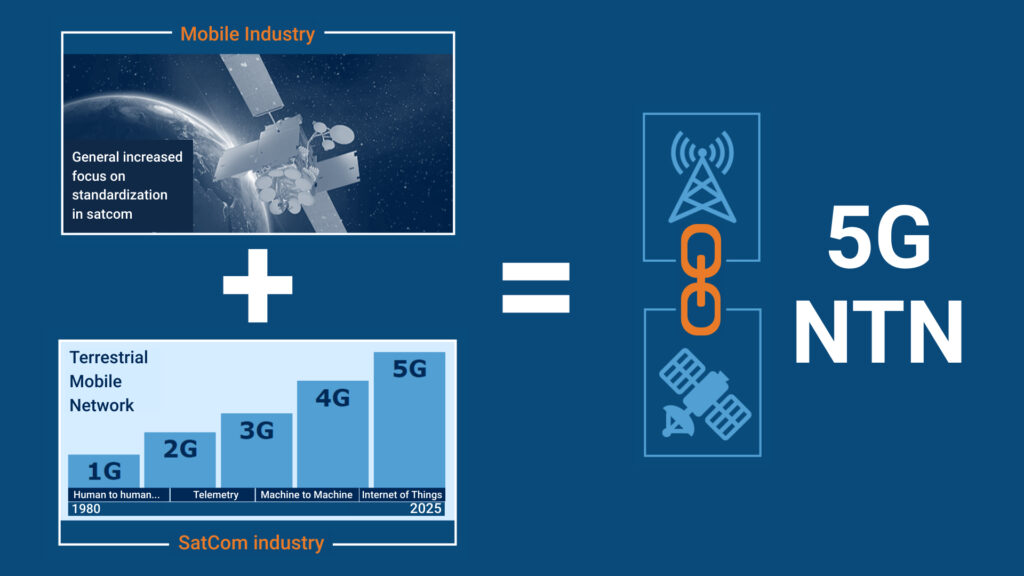

SatCom technology is indeed a promising way to connect and extend coverage. It only gets better with the help of the telecom industry — if both technologies find a way to work together. The telecom industry must accept the specialized and technical challenges of the satcom industry. While the satcom industry must find a way to accept the need for adopting standardization, work to reduce the long lead times on infrastructure changes, and more.

The good news: at least for Europe, both the telecom and satcom industries are increasingly looking to cooperate on top of being backed by EU programs to increase the European industry’s footprint.

Additionally, technologies such as 5G are promising. For instance,

- Chipsets used in terminals will come to support both modes without additional costs

- Terminals will be capable of seamless switching between terrestrial and satellite-based networks

- Prices for satellite connectivity devices will drop dramatically

- Mobile operators will drive the growth – just selling ordinary subscriptions now with the possibility to also provide services beyond terrestrial coverage

How Gatehouse SatCom Is Inching Towards Better Connectivity

3 years ago, we at Gatehouse started building a communication protocol – waveform – for satellite based 5G connectivity by building both the network component and the terminal component. Further, we successfully onboarded Sateliot as the first customer – a Spanish start-up satellite operator working to offer space based IoT services using 5G standards.

We have Proof of Concept and design simulations. We proved that it works (on a theoretical level), after following it up with demonstrators in orbit to ensure that it works in real life. Satellite operators are currently showing interest in this opportunity to get on the 5G/6G evolution train and tap into the growth opportunities and service improvements while working on making changes to their existing business models. There’s promise: Connectivity in the future is all set to change.

How do you think the future will look as far as how satcom and mobile networks merge? What are the possibilities of the convergence?

Other news

Let’s get in touch

Get in touch with us to learn how embedded satellite communications software can enable your roadmap to compete in the rapidly evolving market for connectivity. You can contact us with any specific inquiries or to set up a meeting.

We look forward to hearing from you and to discuss your satellite communications software needs.